Homeowners Insurance Requirements: What You Need to Know

Homeownership is a significant milestone in many people’s lives, but it also comes with various responsibilities, including the need for homeowners insurance. Homeowners insurance provides financial protection against unexpected events that could damage or destroy your home. Understanding homeowners insurance requirements is crucial for safeguarding your investment and ensuring peace of mind. This article by Aboutro serves as a comprehensive guide to help you navigate homeowners insurance requirements and make informed decisions.

Homeowners Insurance Requirements: What You Need to Know

- The Importance of Homeowners Insurance:

a. Protection Against Losses: Homeowners insurance is designed to protect your property from a range of perils, including fire, theft, vandalism, and natural disasters. It provides coverage for the structure of your home, personal belongings, and liability protection in case someone is injured on your property.

b. Mortgage Lender Requirements: If you have homeowners insurance requirements a mortgage, your lender will likely require you to have homeowners insurance. Lenders want to protect their investment by ensuring that the property is adequately insured. Failure to obtain homeowners insurance may violate the terms of your mortgage agreement.

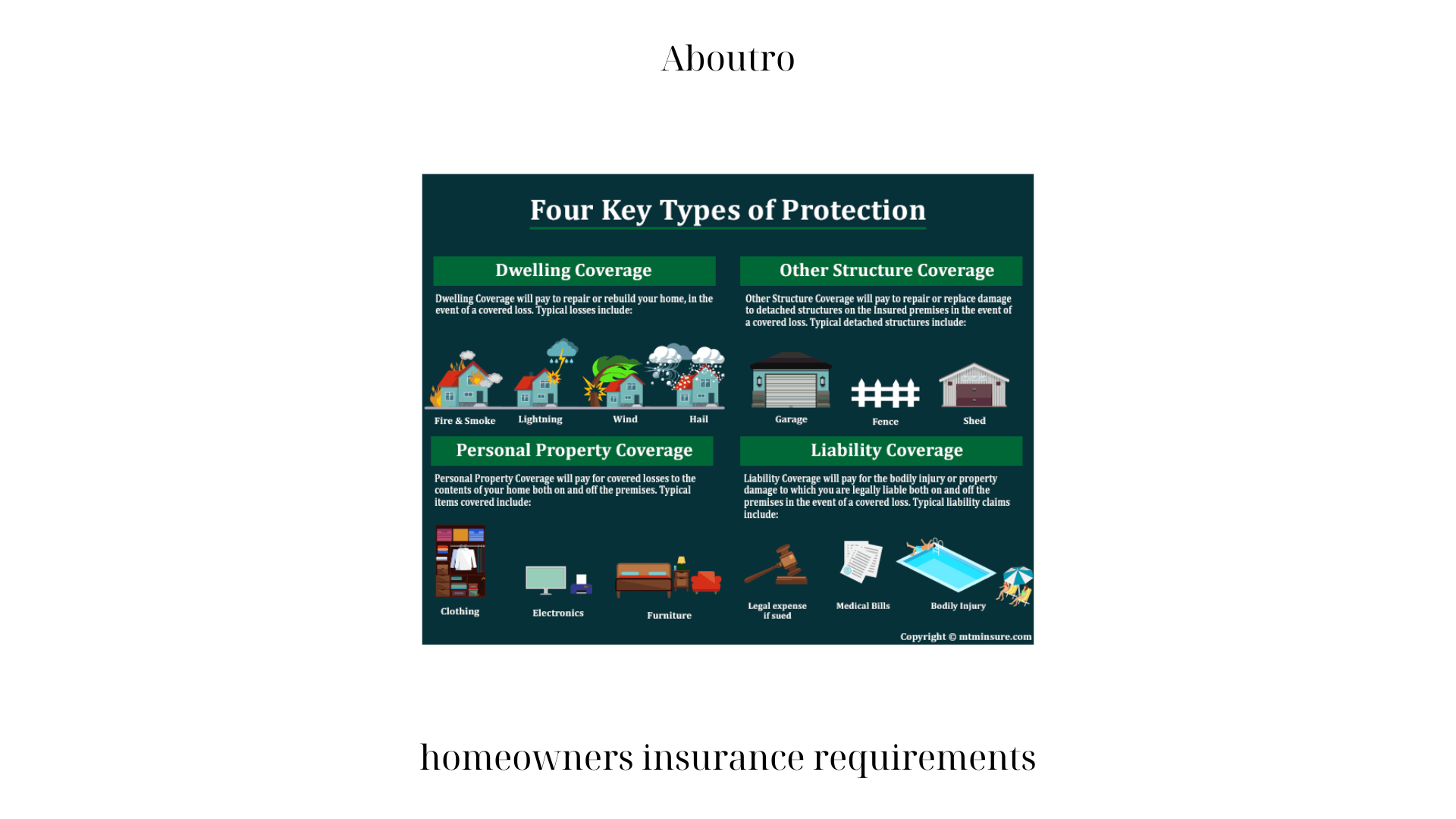

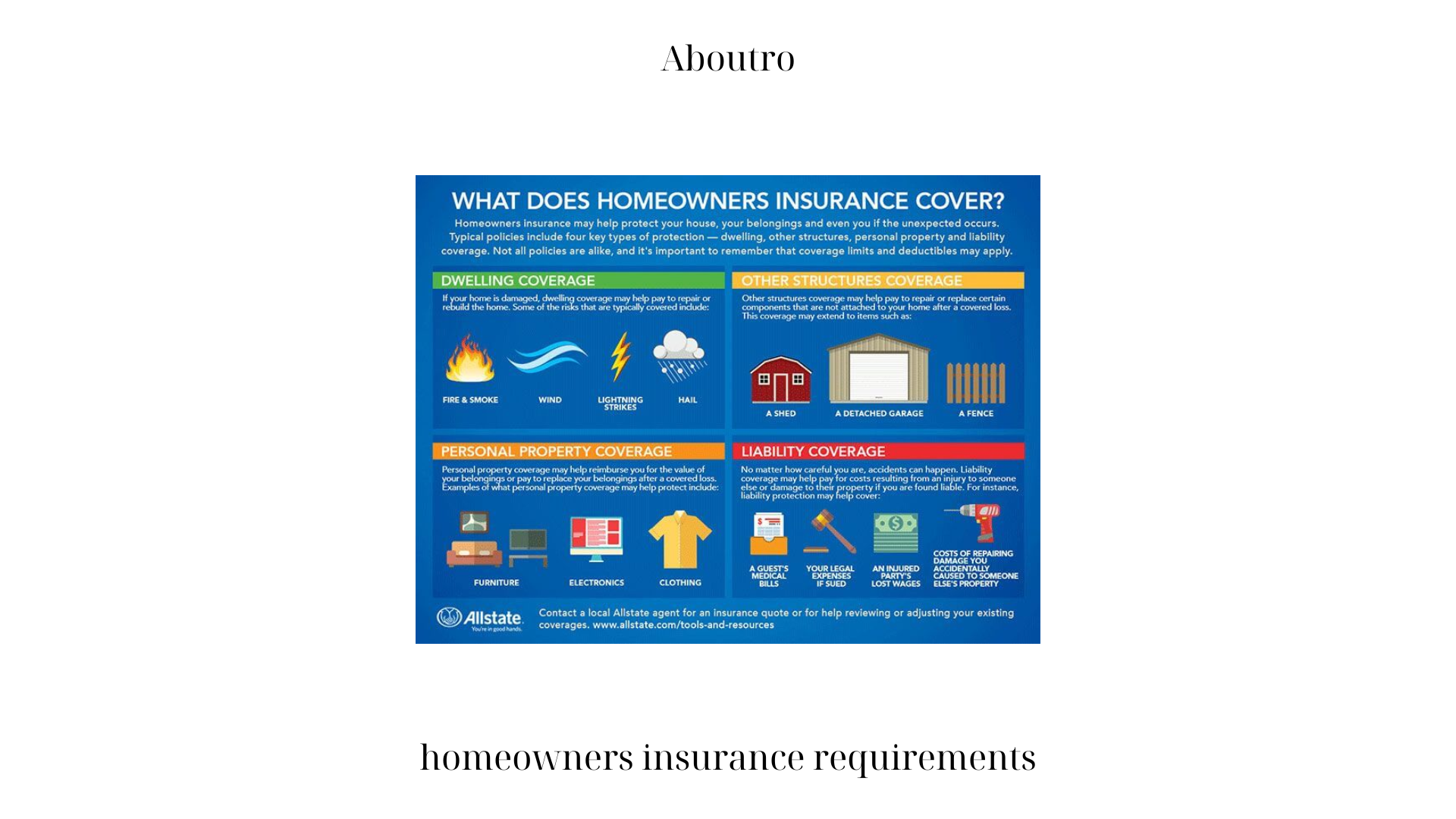

- Understanding Coverage Types:

a. Dwelling Coverage: Dwelling homeowners insurance requirements coverage protects the structure of your home, including the walls, roof, floors, and built-in appliances. It typically covers damage caused by fire, windstorms, hail, lightning, and other specified perils.

b. Personal Property Coverage: Personal property homeowners insurance requirements helps replace or repair your belongings, such as furniture, clothing, electronics, and appliances, if they are damaged or destroyed by covered perils. It’s important to review the policy limits and consider additional coverage for high-value items like jewelry or artwork.

c. Liability Coverage: Liability coverage protects you if someone is injured on your property and you are found legally responsible. It can cover medical expenses, legal fees, and damages awarded in a lawsuit.

d. Additional Living Expenses Coverage: In the event that homeowners insurance requirements your home becomes uninhabitable due to a covered loss, additional living expenses coverage helps pay for temporary living arrangements, such as hotel stays or rental accommodations, and related expenses.

- Factors Affecting Homeowners Insurance Premiums:

a. Location: The location of your home plays a significant role in determining insurance premiums. Factors such as the risk of natural disasters, crime rates, and proximity to fire stations or hydrants can impact the cost of coverage.

b. Home Characteristics: The age, homeowners insurance requirements construction materials, and size of your home can influence insurance premiums. Older homes or those made of materials prone to damage may result in higher premiums.

c. Deductible Amount: The deductible is the amount you are responsible for paying out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premiums but increases your financial responsibility in the event of a claim.

d. Insurance Score: Insurance companies often consider homeowners insurance requirements credit-based insurance scores when determining premiums. Maintaining a good credit history can lead to more favorable rates.

- Additional Coverage Options:

a. Flood Insurance: Standard homeowners insurance policies typically do not cover flood damage. If you live in an area prone to flooding, obtaining separate flood insurance is crucial.

b. Earthquake Insurance: Similarly, earthquakes are not homeowners insurance requirements covered by standard homeowners insurance. If you reside in an earthquake-prone region, consider purchasing earthquake insurance to protect your home and belongings.

c. Umbrella Insurance: Umbrella insurance provides additional liability coverage beyond the limits of your homeowners policy. It offers broader protection and higher coverage limits, offering added peace of mind.

- Reviewing Policy Limits and Exclusions:

a. Policy Limits: It is essential to review the homeowners insurance requirements limits of your homeowners insurance policy. Ensure that the coverage adequately reflects the value of your home and possessions. Consider updating your policy as your home’s value changes over time.

b. Exclusions: Homeowners insurance policies have exclusions, which are specific situations or perils that are not covered. Common exclusions include damage caused by earthquakes, floods, or normal wear and tear. Understanding these exclusions can help you determine if additional coverage is necessary.

- Shopping for Homeowners Insurance:

a. Obtain Multiple Quotes: It’s wise to compare quotes from several insurance providers to ensure you’re getting the best coverage at a competitive price. Consider factors such as coverage options, deductibles, and customer reviews when selecting an insurance company.

b. Seek Professional Guidance: If navigating homeowners insurance requirements seems overwhelming, consider working with an insurance agent or broker who specializes in homeowners insurance. They can help assess your needs and guide you through the process of selecting the right coverage.

c. Bundle Insurance Policies: Many insurance companies offer discounts when you bundle multiple policies, such as homeowners and auto insurance. Consolidating your insurance needs with one provider can result in cost savings.

Conclusion

Homeowners insurance requirements are a vital aspect of homeownership. Understanding the coverage types, factors that influence premiums, and additional coverage options is essential for protecting your home, belongings, and financial well-being. By reviewing policy limits, considering exclusions, and shopping around for the best coverage, you can ensure that you meet homeowners insurance requirements while obtaining comprehensiveprotection.

Remember, homeowners insurance is not a one-size-fits-all solution, so take the time to assess your needs, consult with professionals if needed, and make informed decisions to safeguard your home and investment. With the right homeowners insurance coverage in place, you can enjoy the confidence and peace of mind that comes with knowing you are protected against unexpected events.